missouri gas tax increase 2021

Mike Parson signed the increase into law in July. When fully implemented on July 1 2025 the gas tax would be 299.

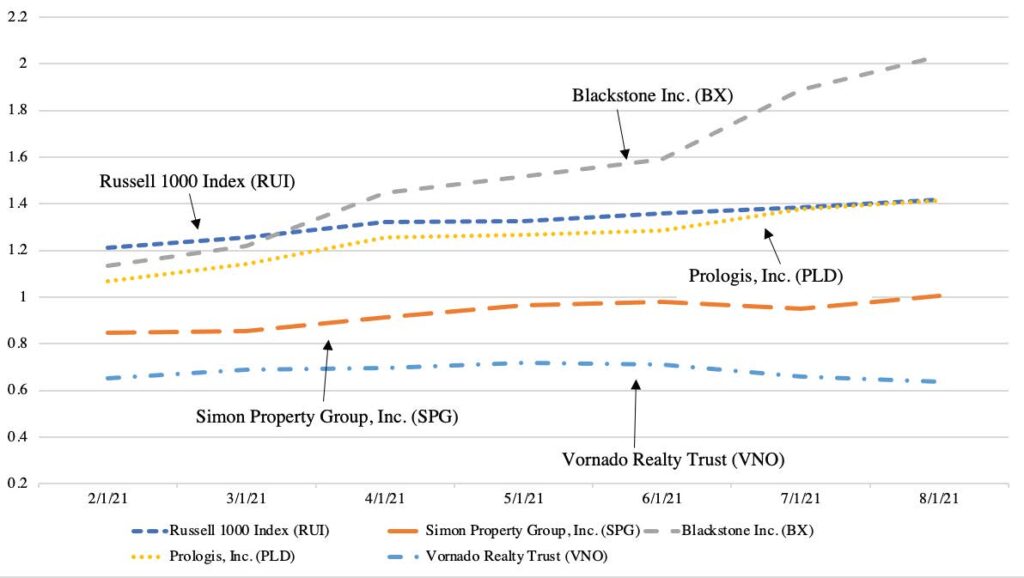

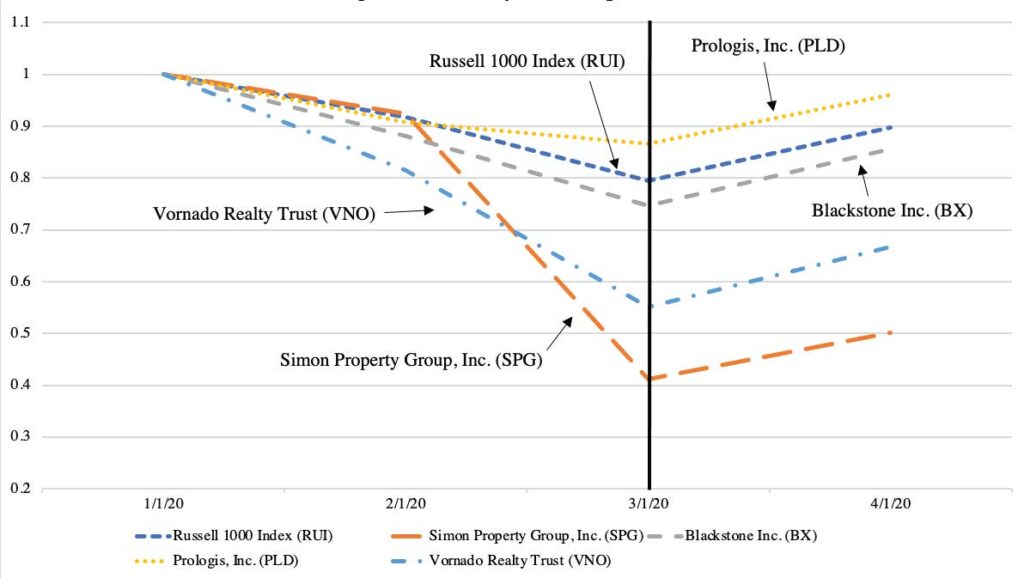

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Missouris gas tax is about to go up another 25 cents a gallon after state lawmakers passed the increase in 2021.

. Today the Missouri Legislature passed a 125 per gallon fuel tax increased to be phased in at the rate of 25 cents per year from 2021 to 2025. Mike Parson greenlit an incremental gas tax increase Tuesday bumping it up to 295 cents from 17 cents by 2025. May 12 2021By Alisa Nelson The Missouri Legislature has passed a proposal that would boost the states gas and diesel tax for the first time in about 25 years.

If you have more than 10 vehicles for which. KANSAS CITY Mo. The tax would go up 25 cents a year starting in October 2021 until the.

Senate Bill 262 you may be eligible to receive a. 1 2021 Missouri increased its gas tax to 0195 per gallon. Missouri lawmakers who passed the incremental gas tax increase in 2021 did so when fuel was less than 3 per gallon.

The Missouri Senate also passed legislation on Thursday that would raise the states gas tax. 1 2021 Missouris current motor fuel tax rate of 17 cents per gallon will increase to 195 cents per gallon. House Transportation Chair Becky Ruth called.

This is part of the states plan to increase. Yes the issue had gone to voters a couple of times in. Missouris gas tax will go up by 125 cents over the next five years 25 cents a year starting this October.

The tax is set to. To request a refund of the of the motor fuel tax increase for fuel. Senator Dave Schatz of Sullivan.

Posted at 411 PM May 09 2021. Missouri voters havent approved of a gas tax increase since 1996. The tax will increase an additional 25.

KY3 - The Missouri Attorney General turned down a request Friday morning to put the legislature-approved gas tax hike to a statewide vote which. On July 1 2022 the gas tax will rise again to 022 per gallon. The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

Mike Parson signs the bill would take effect in five steps of 25 cents each starting Oct. Missouri lawmakers May 11 approved raising the state gas tax 125 cents per gallon over five yearsThe bill could increase funding for roads and bridges by. It addressed what I think is the best.

Drivers filling up their tanks in Missouri will pay an additional 25 cents per gallon of gas effective Friday. Increase Paid Supporting Worksheets Gallons x 0025 Vehicle Missouri Motor Fuel Tax Does Not Exceed 26000 Pounds Total Add Lines 1-10. In this final week of the Missouri Legislatures regular session a proposed gas tax hike is expected to jump into the drivers seat.

A 7 sales tax and a 32-cents-per-gallon tax aimed at funding road projects. 14 hours agoThe state actually levies two separate taxes on gasoline. May 10 2021 By Alisa Nelson.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer. JEFFERSON CITY Mo. In April a House committee has unanimously endorsed a proposal to increase Missouris gas tax sending the measure to the full House.

The sales tax calculated monthly just. 1 until the tax hits 295 cents per gallon in July 2025. Beginning in October 2021 when the new law kicks in an additional 25 cents per gallon tax on motor fuel in Missouri will be collected.

The tax if Gov.

Pritzker S Record 24 Tax Fee Hikes Taking 5 24 Billion More From Illinoisans

Beau Beaubien Beaubeaubien Twitter

How The Infrastructure Package Would Hurt The Middle Class

Ladue To Seek Tax Rate Increase To Support City Services Metro Stltoday Com

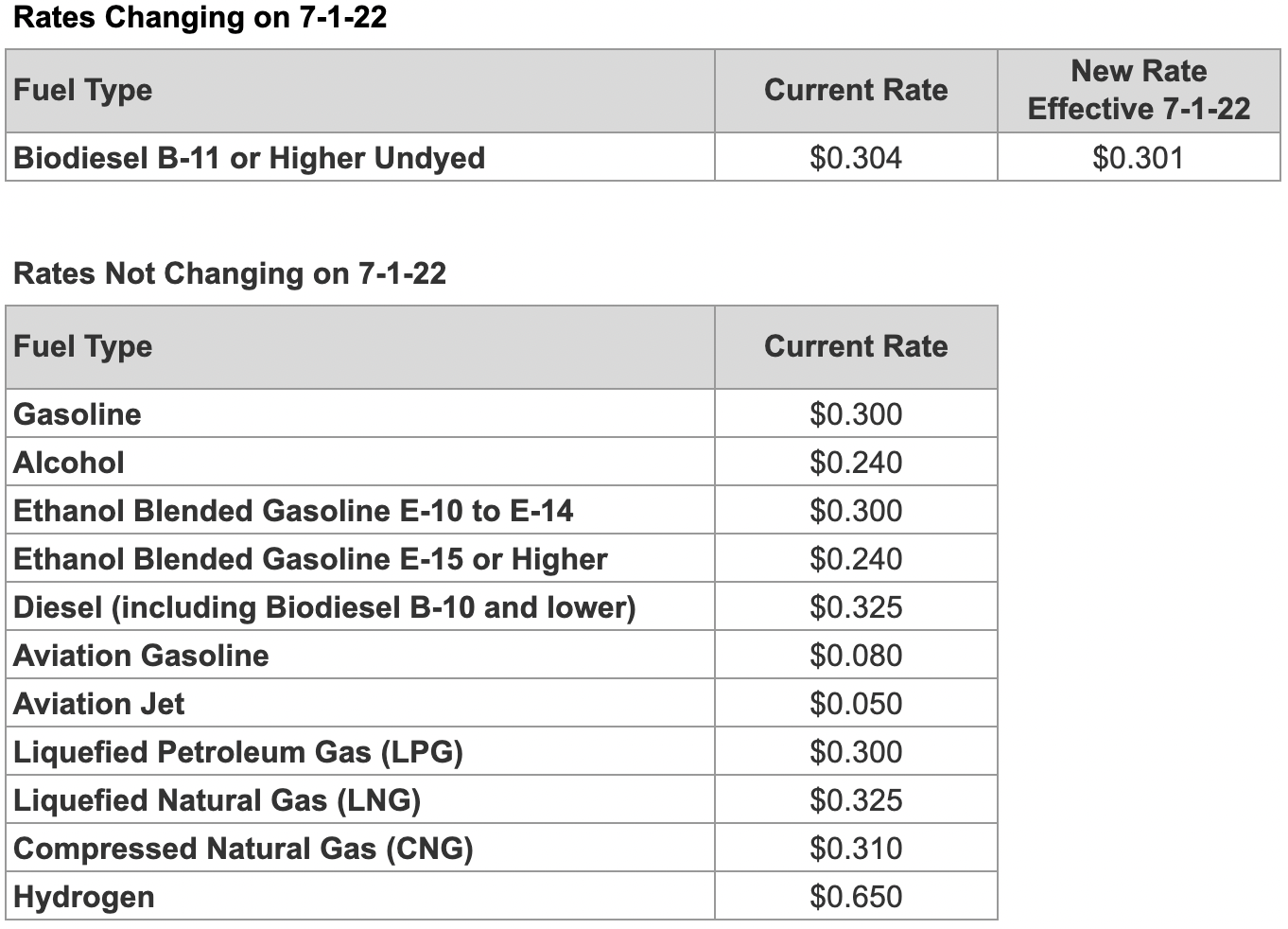

The New Trend Short Sighted Tax Cuts For The Rich Will Not Grow State Economies Itep

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Would Gas Tax Breaks Make A Big Difference When Prices Are Skyrocketing We Asked 4 Experts

States Tackle High Gas Prices With Tax Holidays Rebates For Residents

Would Gas Tax Breaks Make A Big Difference When Prices Are Skyrocketing We Asked 4 Experts

Dave Schatz Jumps Into Us Senate Race The Missouri Times

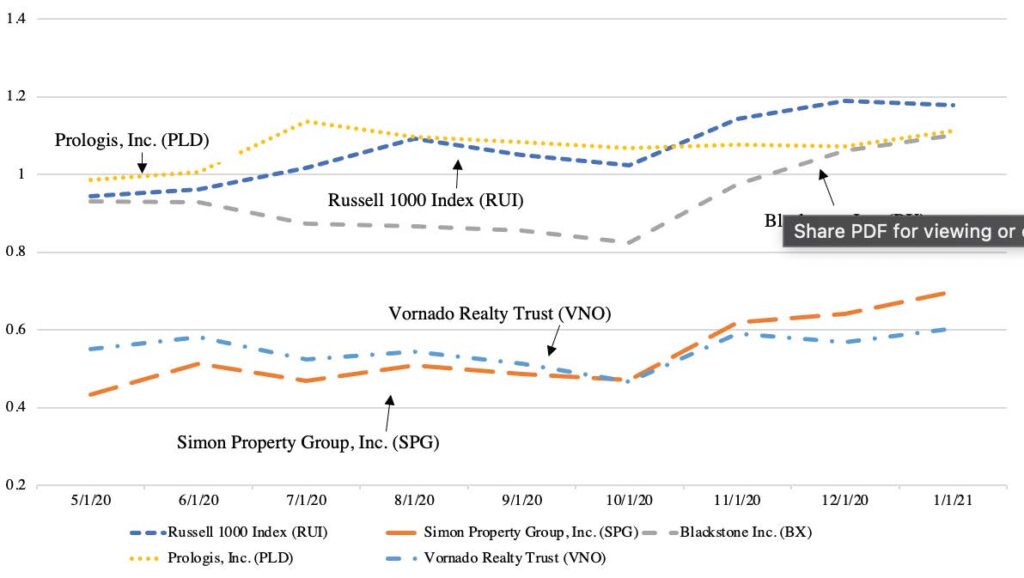

Iowa Fuel Tax Rate Change Effective July 1 2022 Iowa Department Of Revenue

The New Trend Short Sighted Tax Cuts For The Rich Will Not Grow State Economies Itep

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Why States Continue To Overrule Local Regulation Of Fossil Fuels

Here S How Missouri S Spike In Gas Prices Compares To The Nation Missouri Thecentersquare Com

States Tackle High Gas Prices With Tax Holidays Rebates For Residents

State Corporate Tax Throwback Rules And Throwout Rules

States Tackle High Gas Prices With Tax Holidays Rebates For Residents